I discovered Mint about a year ago, and it has made my life so much easier. The basic premise of the site is aggregation of your accounts. You enter your online login information for your banking, loans, or other financial accounts, and then Mint combines them all into one easy to use tool. This is not a paid endorsement, I didn't get any freebies (other than the use of their site, which is always free) - it just has worked wonders for me.

There are a few areas where Mint is very very helpful. I find numbers 4 and 5 below to be the most helpful.

1: Categorizing your spending.

Mint automatically categorizes all transactions in your transaction history into different categories. For example, a credit card charge at (insert grocery store name here) will automatically be categorized as groceries, or food and dining. A trip to Shell will be categorized as gas. When these are categorized, you can view your expenses as part of a whole - do you spend 1% or 10% of your money on gas?

Mint also allows you to compare your spending from month to month or year to year. You can see where your expenses have changed.

3: Compare your spending to others.

By anonymizing your data and others on the site, you can compare your spending habits to other people in your city, region, or nation-wide. If you see that you're spending $500 more per year on auto insurance than the average person, you can take action to try and find cheaper rates.

4: Simple, easy budgeting.

The best feature on Mint is the budget tool. Remember that plan you came up with in Step 3? Well here is where you make it nearly automatic and incredibly easy. Enter your budgeted amounts into Mint's categories (groceries, gas, insurance, etc) and then relax.

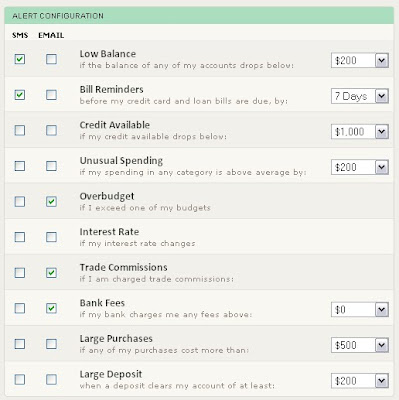

5: Alerts

The last really helpful feature Mint offers is the ability to set alerts. You can have these alerts sent in an email or as a text message. You can set alerts to tell you when you have a low balance, when you exceed your budget, when bills are do, or a whole host of other important things. That way, if you exceed your 'shopping' budget for the month, you can get an email to remind yourself not to spend anymore until the next month.

3 comments:

I really need to try Mint.com out. I had no idea you could do some of that stuff!

Thanks for the comment! I totally recommend Mint. It makes it so much easier to keep track of where your money is going, and you only have to do minimal maintenance to make sure your purchases are being categorized correctly. Check it out and let me know if it helps!

Thank you for sharing a lot of things inside your blog. I'm looking forward for more of your updates. Thanks again.

Post a Comment