The first week, the topic is the Law of Supply and Demand.

The law of supply and demand has three parts:

1. Excess supply leads to lower prices

2. High demand leads to high prices

3. Markets tend toward the point where supply=demand

Now, these three parts are not absolute. A market may take a while - even years - to correct itself. But eventually, things will revert towards the point where there is neither excess supply nor excess demand.

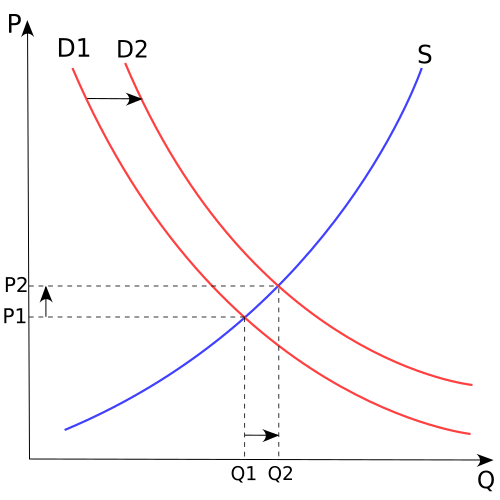

In the following graph, D1 and D2 represent demand curves, and S represents supply. The graph shows several key concepts:

1. Demand decreases as price increases (no thanks, I don't want that $600 iPhone, I'll wait until its $300)

2. Demand increases as price decreases (buy one get one free!)

3. Price increases as supply decreases (think rare artifacts or pop stars' famous items, like Madonna's bra or Michael's sequined glove)

4. Price decreases as supply increases (think mass produced Walmart products made in China)

Now, I'm not just spewing theoretical rhetoric for the heck of it. There is a very critical, practical application for this. When people forget the law of supply and demand, or pretend it doesn't exist, things get out of whack and you get a "bubble".

Take the housing bubble for example. Because of the proliferation of irresponsible credit lending, people forgot that houses were becoming unaffordable. They thought that prices always rise, so they could continue to buy and sell at higher and higher prices. To me, this just seems illogical. Couple this with a massive increase in supply (due to housing construction), and you have an unsustainable problem. Remember the fourth concept from above: Price decreases as supply increases. When supply is increasing and prices are increasing, you get further and further away from the equilibrium point where supply = demand.

So let this be a reminder/warning. If someone says "this market is different" or "old economic theories don't apply anymore!", just nod, smile, and ignore them completely. Bubbles form when people buy things out of emotional excess rather than sound, logical thinking. If you think "this is crazy!", you're probably right. Don't try to time the market, either. There were plenty of people who recognized that we were in a bubble, wanted to make as much money as possible while it was happening, but didn't get out in time and lost tons of money. Don't be one of them!

2 comments:

Great Post! It's good to know that other people realize the nature and necessity of the business cycle. I look forward to reading about another topic next Thursday.

The hypothesis you described only happens in a perfectly competitive market with symmetrical price information, no externalities, perfect capital and labor mobility, no barriers to entry, and where all participants are price-takers. This is unlikely to happen in real life; most markets fall somewhere between the theoretical extremes of perfect competition and monopoly.

I would argue that the housing bubble was more likely a result of aggressive mortgage origination sales techniques that inadequately disclosed unfavorable lending terms to borrowers, combined with a federal tax scheme whereby all income-earners subsidize the acquisition costs of real property owners. This only explains WHY the bubble was in real estate; had some other asset class seemed more favorable it is inevitable that irresponsible risk-taking would've occurred there.

In other words, unrealistic levels of new home construction was a symptom of a greater problem. This problem was a loosely regulated market environment which allowed for excessive opportunistic lending. In the decades following the Great Depression, mortgage banks were operated in a manner similar to public utilities. Their profit margins were set at a modest level by local commissions. We should return to such a system, especially if taxpayers will be held liable for the banks' losses through government bailouts.

Post a Comment