Since this is National Save for Retirement Week, today's websites will feature online companies that allow you to create and maintain retirement savings accounts.

Before I launch into a list of links, I'll give a quick background of the different types of accounts. I'll go into each in more detail later this week, but for now, lets say there are two major types of retirement accounts.

The first is the 401k. This is a tax advantaged account that is generally an 'employer-sponsored' plan. That means, when you leave one job for another, you have to transfer your 401k account to your new employer. Many employers also offer matching contributions, say for 3% of salary. Employer contributions are free money - make sure you are taking advantage of it!

The second type of account is the IRA, or Individual Retirement Account. Like it's name implies, this account is tied to you, not your employer. You can change jobs every week if you'd like, but you don't have to change your account information for an IRA. You do not get employer matching for this type of account.

There are limits as to how much money you can put in each account during the year, since they are "tax advantaged" accounts. That means that there are tax benefits associated with saving for retirement.

If you choose the 'traditional' IRA or 401k, you put money in pre-tax, and are only taxed when you make withdrawals in retirement. This type of account is good if you think your tax bracket is higher now than it will be when you retire. It also serves to decrease your current taxable income, so you will pay fewer taxes in the present.

If you choose the "Roth" IRA or 401k, your money is put in after taxes have already been taken out, but you never have to pay tax on the gains that investment makes. So if you manage to turn $10,000 into $100,000 by the time you retire, you will have been taxed on the original $10,000 at your current tax rate, but you will not be taxed on the $90,000 your money earned. This type of account is best if you think your tax rate now is lower than what it will be when you retire. So if you are starting out at an entry level job in one of the lower tax brackets, this may be the best account for you currently.

You can also have both. I currently do - I put money into both a Roth IRA and Roth 401k, but my employer's contribution gets directed to a Traditional 401k.

Now that you get the basic idea of what types of accounts there are, here is a listing of websites that allow you to create and fund your own account.

Etrade

ING Direct

Fidelity

Bank of America

Scottrade

Note: You should check out the list of potential fees before opening any account. Some of these sites will charge an annual fee, but not charge for trades, while others will charge for trading but not have an annual fee. You need to determine how you will most likely handle your money, and pick the one that suits your personal investment style.

Showing posts with label website. Show all posts

Showing posts with label website. Show all posts

Wednesday Websites #4: Retirement Accounts

Posted by

Jenny

on Wednesday, October 21

Labels:

401k,

IRA,

retirement,

roth,

traditional,

website,

wednesday website

/

Comments: (0)

Wednesday Website #3: Gift Cards at a Discount

Posted by

Jenny

on Wednesday, October 14

Labels:

gift cards,

gifts,

website,

wednesday website

/

Comments: (2)

On Monday we featured a way to save on your digital music habits. This week's Wednesday Website is a great way to save money at stores you already know you're going to shop at, or to save money on gifts for birthdays or holidays.The following websites feature gift cards at a discount - 10%, 15%, or more.

Plastic Jungle: Probably the most popular of the gift card recycling websites, Plastic Jungle has a cute, user friendly interface and a slew of merchants to choose from. You can find almost any store you need - Home Depot, Lowe's, Macy's, Sears, Best Buy, Victoria's Secret, Old Navy, TJ Maxx, JC Penney, you name it. They also offer some pretty awesome discounts. As I write this, they are offering a $25 Godiva gift card for only $17.50. That's a great way to save some serious cash on your Christmas shopping! Even better, if you are feeling philanthropic, you can choose to donate 100% of the amount on your card to a classroom in need.

GiftCards.com: This website is a little less fashionable/user-friendly, but it does have spots where it outshines Plastic Jungle. They too have discounted gift cards for common merchants, though the selection is a little more limited. On the up side, they have an option to create customizable VISA gift cards. You can choose your amount, upload a photo, and have it sent to the person in a personalized card. This is great if you can't figure out what someone wants as a gift, but want a little more security than giving out cash.

Plastic Jungle: Probably the most popular of the gift card recycling websites, Plastic Jungle has a cute, user friendly interface and a slew of merchants to choose from. You can find almost any store you need - Home Depot, Lowe's, Macy's, Sears, Best Buy, Victoria's Secret, Old Navy, TJ Maxx, JC Penney, you name it. They also offer some pretty awesome discounts. As I write this, they are offering a $25 Godiva gift card for only $17.50. That's a great way to save some serious cash on your Christmas shopping! Even better, if you are feeling philanthropic, you can choose to donate 100% of the amount on your card to a classroom in need.

GiftCards.com: This website is a little less fashionable/user-friendly, but it does have spots where it outshines Plastic Jungle. They too have discounted gift cards for common merchants, though the selection is a little more limited. On the up side, they have an option to create customizable VISA gift cards. You can choose your amount, upload a photo, and have it sent to the person in a personalized card. This is great if you can't figure out what someone wants as a gift, but want a little more security than giving out cash.

Monday Money Saver #3: Free Music

Posted by

Jenny

on Monday, October 12

Labels:

monday money saver,

music,

pandora.com,

playlist.com,

website

/

Comments: (0)

I know it's pretty easy to hear a song you like, and click a couple clicks, pay the $0.99, and download it to your computer. But that adds up really fast. A few songs a week and you're at a couple hundred dollars per year!

But there is a better way - as long as you have an internet connection! The following websites are excellent places to listen to free music - legally.

1. Pandora - pandora.com

Pandora is a website that uses algorithms to identify similar songs or artists. For example, if you want to play a station full of classic rock, enter in a few artists like Led Zeppelin or the Beatles, and it will populate the station with similar songs and artists. If you want pop circa 2000, "seed" the station with Britney Spears, Christina Aguilera, Backstreet Boys, or 'N Sync. You can give a song a thumbs up if you want to hear more like it, or a thumbs down if you don't want it played on that station ever again.

I am pretty sure you can create an unlimited number of stations - at least I haven't hit the limit yet. You can create stations for different moods - I have a "spa" station that I like to listen to while doing yoga, a punk rock station I put on when I'm cleaning the apartment, or even a christmas station I like to play while baking cookies.

The only frustrating thing about Pandora is that you can't ask it to play a specific song. The song you like might show up on your station, but you can't control when it plays. Also, if you listen to more than 30 hours of music in a month, you have to pay a $0.99 fee to continue listening. Even with these little frustrations, Pandora is an awesome music playlist. To keep it free, they do run ads occasionally - but not much more frequently than one 15-20 second ad per half hour. I highly recommend Pandora to those people who want to hear new music in a specific genre, but don't want to test out songs by buying them from iTunes or Amazon.

2. Playlist.com - playlist.com

Playlist.com is the answer to Pandora's inability to play a song on demand. While Pandora is good for generating new music that is similar to music you already like, Playlist is good for listening to songs you already know you like. You can search for specific songs or artists, and then add them to your playlist. So if you want a playlist with every Spice Girl song possible, you can create that, and listen to it as many times as you want. Like Pandora, they play ads on the webpage, but they are minimally invasive. Playlist is great if you've got a song stuck in your head and need to listen to it before it drives you nuts.

Now neither of these websites will work unless you are connected to the internet. For that, you will still need to download your music from a place like Amazon or iTunes. But as long as you have an internet connection, these websites will help curb your purchasing habit, and you can share your stations/playlists with friends. The other great thing is that Pandora is available for many mobile phones - it works on my Blackberry and I'm sure it works on the iPhone as well. Playlist.com won't work on phones yet, until they support Flash.

In the meantime, check them out and let me know what you think!

But there is a better way - as long as you have an internet connection! The following websites are excellent places to listen to free music - legally.

1. Pandora - pandora.com

Pandora is a website that uses algorithms to identify similar songs or artists. For example, if you want to play a station full of classic rock, enter in a few artists like Led Zeppelin or the Beatles, and it will populate the station with similar songs and artists. If you want pop circa 2000, "seed" the station with Britney Spears, Christina Aguilera, Backstreet Boys, or 'N Sync. You can give a song a thumbs up if you want to hear more like it, or a thumbs down if you don't want it played on that station ever again.

I am pretty sure you can create an unlimited number of stations - at least I haven't hit the limit yet. You can create stations for different moods - I have a "spa" station that I like to listen to while doing yoga, a punk rock station I put on when I'm cleaning the apartment, or even a christmas station I like to play while baking cookies.

The only frustrating thing about Pandora is that you can't ask it to play a specific song. The song you like might show up on your station, but you can't control when it plays. Also, if you listen to more than 30 hours of music in a month, you have to pay a $0.99 fee to continue listening. Even with these little frustrations, Pandora is an awesome music playlist. To keep it free, they do run ads occasionally - but not much more frequently than one 15-20 second ad per half hour. I highly recommend Pandora to those people who want to hear new music in a specific genre, but don't want to test out songs by buying them from iTunes or Amazon.

2. Playlist.com - playlist.com

Playlist.com is the answer to Pandora's inability to play a song on demand. While Pandora is good for generating new music that is similar to music you already like, Playlist is good for listening to songs you already know you like. You can search for specific songs or artists, and then add them to your playlist. So if you want a playlist with every Spice Girl song possible, you can create that, and listen to it as many times as you want. Like Pandora, they play ads on the webpage, but they are minimally invasive. Playlist is great if you've got a song stuck in your head and need to listen to it before it drives you nuts.

Now neither of these websites will work unless you are connected to the internet. For that, you will still need to download your music from a place like Amazon or iTunes. But as long as you have an internet connection, these websites will help curb your purchasing habit, and you can share your stations/playlists with friends. The other great thing is that Pandora is available for many mobile phones - it works on my Blackberry and I'm sure it works on the iPhone as well. Playlist.com won't work on phones yet, until they support Flash.

In the meantime, check them out and let me know what you think!

Wednesday Website #2: Mint.com

Posted by

Jenny

on Wednesday, October 7

Labels:

account list,

budget,

mint.com,

website,

wednesday website

/

Comments: (3)

Here it is: the number one website for keeping track of your money - and best of all, it's free!

I discovered Mint about a year ago, and it has made my life so much easier. The basic premise of the site is aggregation of your accounts. You enter your online login information for your banking, loans, or other financial accounts, and then Mint combines them all into one easy to use tool. This is not a paid endorsement, I didn't get any freebies (other than the use of their site, which is always free) - it just has worked wonders for me.

There are a few areas where Mint is very very helpful. I find numbers 4 and 5 below to be the most helpful.

1: Categorizing your spending.

Mint automatically categorizes all transactions in your transaction history into different categories. For example, a credit card charge at (insert grocery store name here) will automatically be categorized as groceries, or food and dining. A trip to Shell will be categorized as gas. When these are categorized, you can view your expenses as part of a whole - do you spend 1% or 10% of your money on gas?

2: Tracking your spending over time.

Mint also allows you to compare your spending from month to month or year to year. You can see where your expenses have changed.

3: Compare your spending to others.

By anonymizing your data and others on the site, you can compare your spending habits to other people in your city, region, or nation-wide. If you see that you're spending $500 more per year on auto insurance than the average person, you can take action to try and find cheaper rates.

4: Simple, easy budgeting.

The best feature on Mint is the budget tool. Remember that plan you came up with in Step 3? Well here is where you make it nearly automatic and incredibly easy. Enter your budgeted amounts into Mint's categories (groceries, gas, insurance, etc) and then relax.

That categorizing aspect I mentioned above? It comes into play here. When you buy groceries, it will automatically deduct that amount from your budgeted amount. You can see how much you have left, in relation to how much time is left in the month. You also have the option to roll over budgets from month to month, so if you spend $400 out of $500 one month, you get an extra $100 to spend the next. Or, conversely, if you overspend one month, it can deduct it from the next month's budget.

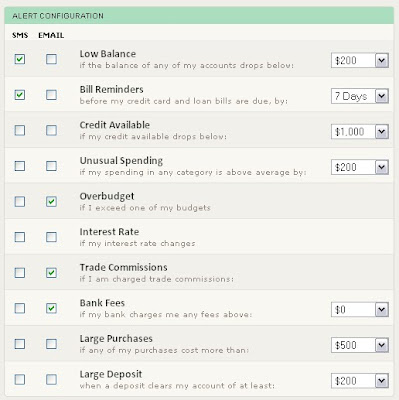

5: Alerts

The last really helpful feature Mint offers is the ability to set alerts. You can have these alerts sent in an email or as a text message. You can set alerts to tell you when you have a low balance, when you exceed your budget, when bills are do, or a whole host of other important things. That way, if you exceed your 'shopping' budget for the month, you can get an email to remind yourself not to spend anymore until the next month.

I discovered Mint about a year ago, and it has made my life so much easier. The basic premise of the site is aggregation of your accounts. You enter your online login information for your banking, loans, or other financial accounts, and then Mint combines them all into one easy to use tool. This is not a paid endorsement, I didn't get any freebies (other than the use of their site, which is always free) - it just has worked wonders for me.

There are a few areas where Mint is very very helpful. I find numbers 4 and 5 below to be the most helpful.

1: Categorizing your spending.

Mint automatically categorizes all transactions in your transaction history into different categories. For example, a credit card charge at (insert grocery store name here) will automatically be categorized as groceries, or food and dining. A trip to Shell will be categorized as gas. When these are categorized, you can view your expenses as part of a whole - do you spend 1% or 10% of your money on gas?

Mint also allows you to compare your spending from month to month or year to year. You can see where your expenses have changed.

3: Compare your spending to others.

By anonymizing your data and others on the site, you can compare your spending habits to other people in your city, region, or nation-wide. If you see that you're spending $500 more per year on auto insurance than the average person, you can take action to try and find cheaper rates.

4: Simple, easy budgeting.

The best feature on Mint is the budget tool. Remember that plan you came up with in Step 3? Well here is where you make it nearly automatic and incredibly easy. Enter your budgeted amounts into Mint's categories (groceries, gas, insurance, etc) and then relax.

5: Alerts

The last really helpful feature Mint offers is the ability to set alerts. You can have these alerts sent in an email or as a text message. You can set alerts to tell you when you have a low balance, when you exceed your budget, when bills are do, or a whole host of other important things. That way, if you exceed your 'shopping' budget for the month, you can get an email to remind yourself not to spend anymore until the next month.

Step 3: Building a Budget for Busy People

In Step 1, you created a list of every account you have - both assets and liabilities.

In Step 2, you checked your credit report to make sure everything was correct.

Now that you have a handle your current and past financial transactions, Step 3 involves creating a plan for future transactions. Having a plan is critical to getting your finances on track. There are thousands of cliche statements about having a plan - failing to plan is planning to fail, a man who does not plan long ahead will find trouble right at his door, a good plan today is better than a perfect plan tomorrow.

Ok so you get the point. Now, some people call their financial plan a budget, some people who don't like the word 'budget' call it a spending plan. Call it whatever you like - the important thing is that you make one!

Luckily, I have found one of the best (and easiest) ways to create this plan. Go to this website and download the spreadsheet by Michael Ham. Fill in as much information as you possibly can - income, debts, retirement goals, plans for buying things in the future, utilities, health insurance (if you are lucky enough to have it) - anything you can think of. If you think you will die without your "eating out" money, or going shopping, by all means add it in. The purpose of creating a budget is not to deny yourself the ability to spend money on things you enjoy. The purpose is to make sure that you can afford the things you want to do and aren't going into unnecessary debt to finance your lifestyle.

Don't forget to budget for emergency savings, either. Without this cash buffer, you are all too vulnerable to unforeseen problems and emergency expenses, which can make you all too dependent on credit cards, or worse, pay-day-loans. You need to have cash set aside in case your car breaks down, in case the air conditioning or heating breaks, or whatever else might happen.

Now, if you are anything like me, the first time you enter your information into the spreadsheet, you'll be in for an unpleasant surprise. If you haven't been saving for retirement, and you haven't been saving for an emergency fund, and you have loans in forbearance, you've probably had more than enough money to finance habits like going out to eat with friends, buying nice wines, shopping - whatever the case may be.

But if you really want to get a hold of your financial future, you need to be realistic. The spreadsheet has a little number at the top that will tell you how much of your income you have left on a monthly basis. If this number is in the red, you are financing your lifestyle through debt - which is simply not an option. You need to play with the numbers - perhaps spend less on restaurants or shopping in order to build up a cash buffer or save for retirement. The loss of the instant gratification of a nice dinner will be more than made up for by the peace of mind you will get by knowing your financial future is protected.

Like that proverb says, a good plan today is better than a perfect plan tomorrow. Even if your situation changes, starting with a plan now is the best thing you can do. You can go in and change your budget every month if you want, but the important thing is to know how much money you have coming in, versus how much you have going out. If you like going to lots of sporting events or concerts, and wonder why you are always scrambling to pay the rent or your credit card bill, this will help you figure it out.

Try to stick to your plan for a month, and see how it goes. Planning for the future is the best way to get ahead!

In Step 2, you checked your credit report to make sure everything was correct.

Now that you have a handle your current and past financial transactions, Step 3 involves creating a plan for future transactions. Having a plan is critical to getting your finances on track. There are thousands of cliche statements about having a plan - failing to plan is planning to fail, a man who does not plan long ahead will find trouble right at his door, a good plan today is better than a perfect plan tomorrow.

Ok so you get the point. Now, some people call their financial plan a budget, some people who don't like the word 'budget' call it a spending plan. Call it whatever you like - the important thing is that you make one!

Luckily, I have found one of the best (and easiest) ways to create this plan. Go to this website and download the spreadsheet by Michael Ham. Fill in as much information as you possibly can - income, debts, retirement goals, plans for buying things in the future, utilities, health insurance (if you are lucky enough to have it) - anything you can think of. If you think you will die without your "eating out" money, or going shopping, by all means add it in. The purpose of creating a budget is not to deny yourself the ability to spend money on things you enjoy. The purpose is to make sure that you can afford the things you want to do and aren't going into unnecessary debt to finance your lifestyle.

Don't forget to budget for emergency savings, either. Without this cash buffer, you are all too vulnerable to unforeseen problems and emergency expenses, which can make you all too dependent on credit cards, or worse, pay-day-loans. You need to have cash set aside in case your car breaks down, in case the air conditioning or heating breaks, or whatever else might happen.

Now, if you are anything like me, the first time you enter your information into the spreadsheet, you'll be in for an unpleasant surprise. If you haven't been saving for retirement, and you haven't been saving for an emergency fund, and you have loans in forbearance, you've probably had more than enough money to finance habits like going out to eat with friends, buying nice wines, shopping - whatever the case may be.

But if you really want to get a hold of your financial future, you need to be realistic. The spreadsheet has a little number at the top that will tell you how much of your income you have left on a monthly basis. If this number is in the red, you are financing your lifestyle through debt - which is simply not an option. You need to play with the numbers - perhaps spend less on restaurants or shopping in order to build up a cash buffer or save for retirement. The loss of the instant gratification of a nice dinner will be more than made up for by the peace of mind you will get by knowing your financial future is protected.

Like that proverb says, a good plan today is better than a perfect plan tomorrow. Even if your situation changes, starting with a plan now is the best thing you can do. You can go in and change your budget every month if you want, but the important thing is to know how much money you have coming in, versus how much you have going out. If you like going to lots of sporting events or concerts, and wonder why you are always scrambling to pay the rent or your credit card bill, this will help you figure it out.

Try to stick to your plan for a month, and see how it goes. Planning for the future is the best way to get ahead!